Britain's Mortgage Crisis

Britain's mortgage crisis has prompted government action, but concerns remain over the effectiveness of the response.

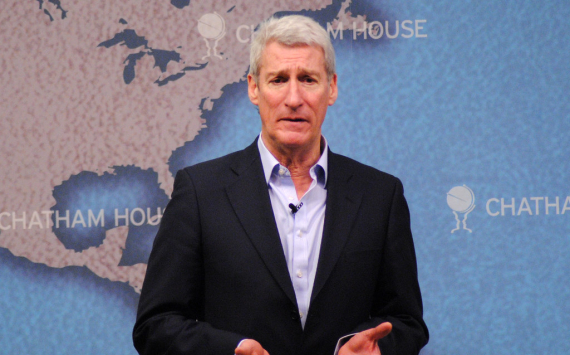

Meeting with Jeremy Hunt

In a high-stakes meeting, Jeremy Hunt hosted executives and regulators to address the pressing mortgage crisis. Despite a week of economic setbacks, including inflation remaining steady at 8.7% and the Bank of England raising the base rate to 5%, the meeting aimed to seek solutions rather than cast blame.

The Mortgage Charter

Introducing the government's voluntary "mortgage charter" to support borrowers and address rising costs. Banks offer flexible repayment terms and repossession procedures without penalizing borrowers. The charter alleviates concerns over escalating rates.

Criticism and Differing Approaches

Praised government efforts criticized by Rachel Reeves. Labour proposes mandatory mortgage sector implementation, distinguishing from piecemeal agreements. Tory MPs urge tax relief on mortgage interest repayments.

David Gauke suggests potential measures like tax hikes to address the distribution of economic burden. In the current scenario, all authorities face the challenge of managing pain during an overheating economy.

Political Realities and the Bank of England

Government's response is shaped by political realities. While aiming to reduce inflation, they recognize the primary control lies with the Bank of England. The foreign secretary admitted limited government control over key levers.

Nothing illustrated this tension better than Thursday’s awkward interview between the foreign secretary James Cleverly and the BBC’s Amol Rajan.

Criticism of the Bank of England

Conservative MPs and economists express concern over Bank of England's crisis management. Governor Andrew Bailey criticized for slow initial response and overcorrection. Doubts raised on institution's credibility and government's reconsideration of independence suggested.

Gerard Lyons of NetWealth suggests that better handling of recent months could have allowed a pause in interest rate rises like the Americans did. Lack of credibility prevented this.

Future Implications and Elections

With concerns over the "mortgage timebomb," the impact of borrowers transitioning from fixed-rate plans on future elections is questioned. Some suggest Prime Minister Rishi Sunak may advance elections to mitigate rate rises before voters feel the pain.