REA’s Bold Bid Battle

REA, the Australian property portal under Murdoch's influence, has made a bold move, appealing directly to Rightmove shareholders following the rejection of its third takeover offer. In what analysts at Jefferies have dubbed a potential "last throw of the dice," REA aims to rally investor support to spur negotiations before the critical deadline on September 30.

The latest bid, valued at £6.1 billion or 770p per share, surpasses previous offers of 705p and nearly 750p, which positioned Rightmove's valuation at £5.6 billion and £5.9 billion, respectively. Despite these efforts, Rightmove’s board deemed the latest proposal to be a substantial undervaluation of the company and its future potential.

In a recent update to the London Stock Exchange, REA expressed its deep frustration over Rightmove’s lack of engagement, stating that it has yet to receive any substantial feedback beyond the rejections of its prior proposals. “REA urges Rightmove shareholders to encourage the board to engage in constructive discussions to work towards a recommended transaction,” the company emphasized, reinforcing its belief that the enhanced offer represents a "highly compelling proposition" for Rightmove investors.

The Australian firm insists that its acquisition would offer Rightmove shareholders much-needed certainty while providing opportunities to benefit from a combined entity. REA remains poised to engage with Rightmove’s board, advocating for a collaborative approach in these negotiations.

As the pressure mounts, REA reflects on Rightmove's prior dismissal of its initial overtures as “opportunistic.” Some investors have also critiqued the proposed deal structure, which blends cash and shares from the combined entity.

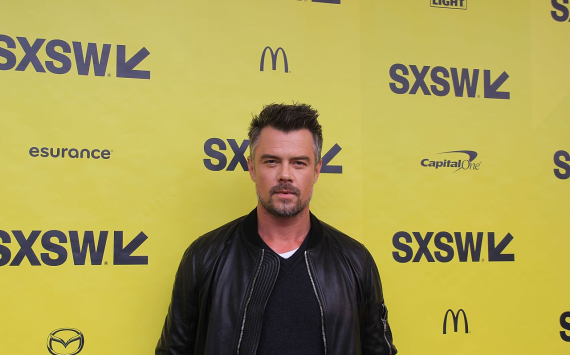

Owen Wilson, REA’s chief executive, articulated the urgency of the situation: “We live in a world of intensifying competition, and this proposed transaction would bring together two highly complementary digital property businesses for investment and growth.”

This ongoing pursuit coincides with Rupert Murdoch's News Corp strategy to diversify beyond its media roots, as his son Lachlan prepares to take the helm of the family empire.