Battle Against Inflation

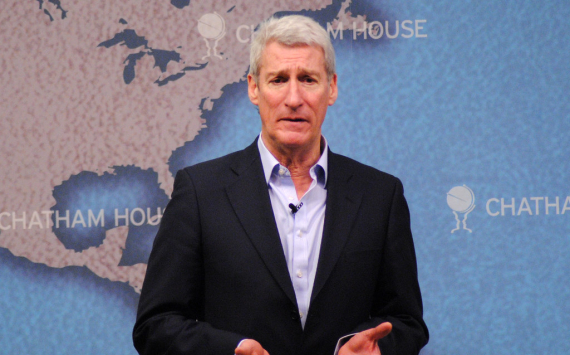

Chancellor Jeremy Hunt has organized a meeting with industry regulators to tackle the problem of price hikes driven by rampant inflation.

The meeting, happening on Wednesday, will involve representatives from the Competition and Markets Authority (CMA) and regulators for energy, water, and communications. The main focus of this meeting is to investigate possible profiteering concerns in these sectors and assess the steps being taken to resolve them.

The decision to convene this meeting stems from the Bank of England's suggestion that certain retailers have been increasing prices or failing to pass on reduced costs to consumers, all in an attempt to boost their profit margins amidst stubborn inflation. Prime Minister Rishi Sunak has urged retailers to exercise responsible and fair pricing practices, highlighting the burden of excessive increases in household weekly shopping bills.

The comments made by government officials have sparked industry backlash, but the British Retail Consortium (BRC), the leading trade body representing the sector, strongly asserts that supermarkets have consistently implemented a "regular stream of price cuts." This commitment remains intact, even as they operate with remarkably tight profit margins.

Inflation and Interest Rates

Last week's official figures revealed that consumer prices index inflation held steady at 8.7% in May, defying expectations for a decrease. As a result, the Bank of England unexpectedly increased interest rates to their highest level in 15 years in an effort to manage inflation. Despite the impact on mortgage-holders, Prime Minister Sunak underscores the importance of addressing inflation with no viable alternatives.

Addressing the Mortgage Crisis

To address the mortgage crisis, Chancellor Jeremy Hunt recently reached an agreement with banks. The measures include providing borrowers with the option to extend the term of their mortgages or temporarily switch to an interest-only plan, offering relief and flexibility during these challenging times.

Conclusion

Chancellor Jeremy Hunt addresses inflation-driven price increases with industry regulators, despite industry backlash. Bank of England's interest rate hike aims to control inflation. Measures are implemented to alleviate the mortgage crisis.