If you are covering the latest IHT statistics, please see the following comment from Rosie Hooper, chartered financial planner at Quilter:

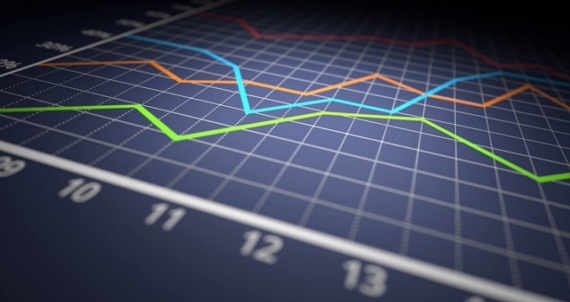

"Today’s HMRC figures show inheritance tax receipts continue to provide a growing source of revenue for the Treasury, with £6.1 billion collected between April 2021 and March 2022.. This is £0.7 billion higher than in the same period a year earlier.

“A key contributor to the increase in IHT receipts is the housing market which increased relentlessly over the same period, in which stamp duty holidays drove the UK to a record high average house price of an eyewatering £360,101, according to Rightmove.

"With thresholds frozen, the increase in IHT revenue is viewed as a stealth tax, as more and more people are dragged into the IHT net following the sale of their homes.

“This tax year, you can pass on £175,000 of your property tax-free, which is effectively doubled to £350,000 when combined with the allowance of your spouse or civil partner. That’s layered on top of your inheritance tax allowance – or nil rate band – of £325,000, meaning it is possible to pass on £1m inheritance free as a couple. However, the RNRB only works for those with direct descendants to inherit the family home, while the UK’s six million cohabitees are less fortunate and cannot claim the combined allowances.

“There are other ways to reduce your inheritance tax exposure, such as gifting to family members. Each tax year you can give away up to £3,000 worth of gifts with your annual exemption, so as a couple you could gift £6,000 a year. In addition, there is no limit on excess income - above expenditure - that can be gifted. Unfortunately, gifting allowances have failed to keep up with inflation, and the currently soaring inflation rates will do little to help matters in terms of IHT bills. If required, you could also consider more significant gifts which would be Potentially Exempt Transfers (PETs) or Chargeable Lifetime Transfers (CLTs), but these will take seven years to see the IHT benefit. As well as reducing the taxable estate value, gifting is particularly useful for estates impacted by the RNRB taper as the gifts can immediately reclaim the extra band.”

Media

Alex Berry

External Communications Manager

+44 (0)7741 151931/alex.berry@quilter.com