Description

BP until may 2001 British Petroleum was a multinational oil and gas company headquartered in London.London. About a third of the company's revenue comes from operations in the United States . In 2010, on an oil production platform leased by the company Deepwater Horizon exploded, causing the largest oil spill in history. Since 2013, BP has owned a 20% stake in the company "Rosneft".

History

The company's founder is a British entrepreneur William Knox D'arcy (1849-1917). In may 1901, he received a concession from the Shah of Persia to search for and extract oil. D'arcy hired George Reynolds as the chief engineer for oil exploration. In the first years, they failed to achieve results. Faced with a lack of qualified personnel, hostility from local residents, and insufficient support from the Persian government, their financial resources faltered, and since 1905, work has continued with the financial and technical support of the Burma oil company ( Burmah Oil)., founded in 1886 in Scotland). The first success came in may 1908, when the Masjed-e Suleiman field was discovered in the southwestern part of Persia, the first not only in Persia, but also in the entire middle East. On April 14, 1909, the Anglo-Persian oil Company was formed , in which Burmah Oil owned 97 % of the shares. The remaining shares were held by the company's first Chairman, Lord Strathcona. D'arcy served as a Director of the company, but did not significantly influence its further development. An oil refinery was built in Abadan, the export of petroleum products that began in 1912, by 1938 this refinery became the largest in the world.

The dominant figure in the company in the early years was Charles Greenway, who had previously worked at Burmah Oil. In 1910, he became managing Director, and in 1914 became Chairman. In the same year, the Turkish oil company created two years earlier was reorganized, and Anglo-Persian acquired 50 % of its shares (Deutsche Bank and Royal Dutch Shell each had 25%). Despite the presence of a rich field, the Anglo-Persian oil company experienced difficulties in refining oil and marketing petroleum products. To avoid being taken over by other oil companies, most notably Royal Dutch Shell, Greenway signed an agreement with the British government in 1914, under which the Anglo-Persian oil company became a supplier of petroleum products to the British Navy, while the government invested £2 million in the company in exchange for a controlling stake. The company remained formally state-owned until 1977, when a part of the stake was sold. These investments and increased demand for petroleum products in recent years The first world war led to the rapid growth of the company, during the period from 1912 to 1918, oil production in Persia increased tenfold, by 1920 the company already had 30 tankers, and in 1917 an oil refinery was built in Persia.Swansea (Wales). Also in 1917, the British government expropriated the British part of the European petroleum Union (a marketing Alliance in which Deutsche Bank played a significant role this part, called the British Petroleum Company, was immediately absorbed by the Anglo-Persian oil company.

During the 1920s, branches were opened in many countries of Europe, Asia and Africa, refineries were built in Scotland and France. In 1927, Greenway was succeeded as Chairman by John Cadman. In 1928, he represented the company at a meeting of the heads of Anglo-Persian Oil Company, Royal Dutch/Shell and Standard Oil of New Jersey at achnacarry castle in Scotland, where a cartel agreement was concluded between these major oil companies to avoid falling prices for petroleum products due to overproduction. Also in 1928, the red line Agreement was signed. Red Line Agreement), under which Royal Dutch Shell, Anglo-Persian, CFP, Exxon, Mobil, Atlantic Richfield, Gulf Oil Corporation, Standard Oil of Indiana and participation and exploration Corporation formed a joint venture Near East Development Company, which was supposed to cooperate with the Turkish oil company in the development of oil inTurkey, Levante, Iraq and on In the Arabian Peninsula (in 1929, the Turkish oil company was renamed the Iraqi oil company).

After the great depression, the company's profits declined, and so did its payments to the Persian government, adding to the already strong anti-British sentiment in the country. In November 1932, Persia revoked the concession of the Anglo-Persian oil company; the dispute was settled inThe League of Nations and in 1933 the company was granted a new concession, which gave for 60 years the right to produce oil in the territory, which was about a quarter of the original. In 1934, the Anglo-Persian Oil Company formed a joint venture with the American Gulf Oil Corporation, called the Kuwait oil company ( Kuwait Oil Company), for oil production in this country. In 1935, Persia was renamed Iran, and accordingly the company became known as Anglo-Iranian oil. World war II attacks on the company by Iranian nationalists resumed, on may 1, 1951.Mohammad Mossadegh was nationalized by the Iranian oil industry (which provided two-thirds of the company's oil production). Protracted negotiations began, the turning point of which was a coup d'etat with the participation of British intelligence and the CIA who overthrew Mossadegh. In August 1954, an agreement was reached under which a consortium of Western oil companies started producing and refining oil in Iran . In this consortium, the share of the Anglo-Iranian oil company, which changed its name to British Petroleum Company in the same year, was 40 %.

The Iranian crisis has forced British Petroleum to diversify its sources of raw materials and expand its operations. Oil production increased in Kuwait and Iraq, and fields were explored in other countries In the Persian Gulf, as well as in Canada, Europe, North Africa and Australia; in 1962, oil production began in Abu Dhabi, and in 1966 in Libya. New refineries were built in Europe, Australia and Aden. In 1947, a petrochemical joint venture was formed with Distillers, which later became known as British Hydrocarbon Chemicals. A second petrochemical complex was built in Baglan Bay, South Wales in 1961, and by 1967 British Petroleum had become the second largest petrochemical company in the UK.

In 1965, British Petroleum discovered a gas field inIn the North sea in British territorial waters, the Fortis oil field was discovered in 1970 (the first of industrial significance in British waters). Also in the 1960s, the company entered the American market, and geological exploration was conducted on the territory of Alaska (in 1969, a large field was discovered Prudhoe Bay in 1968, the company was purchased for the refining and marketing of petroleum products on the East coast of the United States. In 1969, a troubled partnership began with the Standard Oil Company of Ohio (SOHIO), the companies were engaged in a multi-year dispute over the rights to extract Alaskan oil, and also jointly built an 800-mile pipeline.The TRANS-Alaska pipeline, completed in 1977; in 1987, the Ohio-based company was fully absorbed, merged with other American assets, and renamed BP America.

In 1971, oil fields in Libya were nationalized, and in 1979 in Nigeria, this and the 1973 oil crisis caused further diversification of British Petroleum, large investments were made in coal production in the United States, Australia and South America, the European assets of Union Carbide and Monsanto were purchased, as well as the Selection Trust.], a British mining financial house (this was the largest takeover on the London stock exchange at the time). In the first half of the 1980s, about £10 billion was spent on acquisitions, which included animal feed manufacturer Purina Mills and Keiecott, the largest copper producer in the United States.

The company's strategy changed radically when oil prices began to fall in the second half of the 1980s, and coal and other mining assets, as well as stakes in some oil and gas fields, were almost completely sold off. At the same time, Britoil, a company founded by the British government in the 1970s to produce oil in the North sea, was bought, almost doubling BP's total land area in the region. In October 1987, the government Margaret Thatcher sold the state's remaining stake in British Petroleum.

In 1990, the company was taken over by Robert Horton, who began the modernization program of British Petroleum, called "project 1990". Although it was assumed that it would be aimed at simplifying the company's structure, in practice, massive staff cuts began, and in two years the number of employees decreased by 19 thousand (or 16 %). In 1992, British Petroleum reported quarterly losses for the first time in its history, and Horton was dismissed. After him, the post of head of the company was divided into the Chairman of the Board of Directors and the chief managing Director. They continued the reorganization of British Petroleum: over the next few years, another 9,000 people were cut, the network of gas stations in California and Florida was sold, strategic partnerships were created with Mobil Corporation in the European market and with Shanghai Petrochemical Company in the Asian market.

In December 1998, the takeover of the American company Amoco (formerly Standard Oil of Indiana) was completed, the combined company was named BP Amoco plc. In 2000, two more oil companies were bought, Arco (Atlantic Richfield Co.) and Burmah Castrol (this company was formed in 1966 by the merger of Castrol with the same Burmah Oil, which was previously the main shareholder of the Anglo-Persian Oil Company). In 2001, the company's name was simplified to BP plc, and the logo was also changed.

September 1, 2003 BP and the AAR consortium (Alfa group, Access Industries and "Renova) have established a strategic partnership of TNK-BP with assets in Russia and Ukraine. On October 22, 2012, it was announced that "Rosneft has reached an agreement with TNK-BP shareholders on its purchase. BP received $17.1 billion in cash and 12.84% of Rosneft shares held by the Russian company for its stake, while another TNK-BP shareholder, the AAR consortium, received $28 billion (both transactions are independent of each other). Upon completion of the transaction, British BP owns a 19.75 % stake in Rosneft. On March 21, 2013, TNK-BP completely came under the control of Rosneft.

In 2010, an explosion occurred on an oil production platform Deepwater Horizon, which caused the largest oil spill in the history of oil production (4.9 million barrels). To free up funds for the elimination of consequences and payment of fines and compensation, the sale of assets worth $38 billion over three years began. Fines for 2012 amounted to $4.5 billion, and in 2015 another $20 billion was decided in a civil lawsuit against the company.

In July 2018, the company acquired shale oil and gas deposits in the United States from the Australian company BHP Billiton for $10.5 billion.

In August 2019, BP decided to sell its 26% stake in the Alaskan field (including the TRANS-Alaska pipeline) to a private Texas company, Hilcorp Energy, for $5.6 billion. BP was the operator of the prad ho Bay field and since 1977 has produced about 13 billion barrels, reserves are estimated at 1 billion barrels; the current production level is 74 thousand barrels per day, and 1,600 BP employees work in Alaska.

Owners and management

Largest shareholders as of October 2018:

- Barrow Hanley Mewhinney and Strauss (an American subsidiary of the British company Old Mutual plc), it owns 0.89 % of BP's shares, which is 2.2% of its total portfolio of shares;

- The Vanguard Group (an American investment company) also owns 0.89 % of shares, which is 7.1 % of its total portfolio of shares;

- State Street Corporation (an American financial company), it owns 0.83 % of BP's shares, which is 0.11% of its total stock portfolio;

- Dimensional Fund Advisors, Inc. (an American investment company), it owns 0.61 % of the shares;

- FMR Co., Inc. (an American investment company), it owns 0.48 % of the shares, which is 0.08 % of its total stock portfolio;

5 % of the shares have been owned by the company since 2011 "Rosneft".

The management of BP is divided into two categories: the Board of Directors (in 2017, the Board of Directors met 11 times), which form the main direction of the group's development, and the group's managing Directors, who carry out day-to-day management. All of them are appointed by the General annual meeting of shareholders.

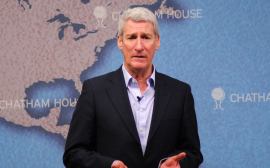

Helge Lund —Chairman of the Board of Directors since the beginning of 2019. Previously, he worked for the oil companies BG Group (CEO from 2015 until the takeover by Royal Dutch Shell in 2016) and Statoil (President and CEO from 2004 to 2014), before that he headed the Norwegian industrial conglomerate Aker Kvaerner. He was also a consultant to McKinsey & Company and the parliamentary group Conservative party of Norway, member of the energy Advisory group Served onthe boards of Directors of Schlumberger (2016-18) and Nokia (2011—14). He is also Chairman of the Board of Directors of the pharmaceutical company Novo Nordisk AS and is a member of the Board of Trustees International crisis group.

Robert W. Dudley has been chief Executive officer (CEO) since 2010. He worked at Amoco Corporation from 1979 until the merger with BP. In 2002, he was appointed Vice President for oil production in Russia, the Caspian region and Africa. From 2003 to 2008, he was President and CEO of TNK-BP. Member of the Board of Directors "Rosneft" since 2013.

Activity

The company produces oil and gas in many parts of the world, both onshore, offshore and in the open sea. At the end of 2017, BP's proven reserves totaled 10.577 billion barrels of oil equivalent, including 4.803 billion barrels (655 million tons) of oil, 336 million barrels of gas condensate, and 893 billion cubic meters of natural gas. The main deposits are located in the United States, Angola, the United Arab Emirates, Argentina, Australia, Azerbaijan, Egypt, Iraq, Trinidad and the United Kingdom.

Daily oil and gas production in 2018 averaged 2.539 million barrels of oil equivalent, including 1.262 million barrels of oil and other liquid hydrocarbons and 208.8 million cubic meters of natural gas. In the United States, 772 thousand barrels were produced, in Europe-179 thousand barrels.

The total capacity of the company's refineries in 2018 was 1.725 million barrels per day, including 703 thousand barrels in the United States and 781 thousand barrels in Europe. The company owns 7 refineries, and 4 more have shares from 10 to 50 %. Three refineries are located in the United States, three in Germany, and one each in the Netherlands, Spain, Australia, New Zealand, and South Africa.

Sales of petroleum products totaled 2.736 million barrels per day, including 1.141 million barrels in the United States and 1.1 million barrels in Europe. There is a network of gas stations in 19 countries, the company is one of the largest suppliers of aviation fuel (at 800 airports in 50 countries), and produces oils under the brand names Castrol, BP and Aral.

Petrochemical production in 2018 totaled 11.9 million tons, including 2.2 million tons in the United States and 4.5 million tons in Europe. Petrochemical complexes are located in the USA (2 plants), Germany (2 plants), China (3 plants), Taiwan (2 plants), great Britain, Belgium, Trinidad and Tobago, Indonesia, the Republic of Korea and Malaysia.

The company owns stakes in 10 gas pipelines and five regasification terminals inThe North sea. In addition, the company owns a 47% stake in the gas pipeline to Alaska, as well as several receiving terminals for liquefied natural gas in the United States.The Gulf of Mexico.

The company is engaged in alternative energy, in particular the production of biofuels (ethanol from cane sugar) in Brazil. DuPont also developed a technology to produce bio-Isobutanol from corn in Kansas. The company owns 14 wind farms in the United States with a total capacity of 1,432 GW. Together with the leading European solar panel installation company Lighthouse, a joint venture Light house BP was created, in which BP's share is 43 %.

Main divisions of BP:

- Oil and gas production (Upstream) - turnover in 2018 was $27.8 billion;

- Refining and marketing (Downstream) - turnover in 2018 was $270 billion;

- «Rosneft holds a 20% stake in the world's largest company in terms of oil production;

- Other businesses and corporate center— this division includes alternative energy, marine transport (49 owned vessels and 22 leased), financial services and insurance; the share of turnover was $807 million.

Regions of operation

Russia

BP owns 19.75 % of the shares "Rosneft, which gives it the right to appoint 2 of the 11 members of the Board of Directors (Robert Dudley and Guillermo Quintero). Dividends for 2017 amounted to $190 million (5.98 rubles per share). In addition, the companies have several joint projects for oil and gas production: joint ventures TAAS-Yuryakh Neftegazdobycha (oil and gas condensate production in Eastern Siberia, 20 %), LLC Ermak Neftegaz (Western Siberia and the Yenisei-Khatanga basin, 49%). BP's share in Rosneft's oil production in Russia, Canada, Venezuela and Vietnam in 2018 was about 923 thousand barrels per day (total oil production of BP was 2.163 million barrels per day, Rosneft-5.5 million barrels per day), natural gas 36 million cubic meters per day.

In January 2011, BP and the Russian state oil company "Rosneft announced the creation of a joint venture that will develop offshore oil and gas fields Kara sea (Rosneft will own 66.67% in it, BP-33.33 %). The companies also agreed to exchange shares (the Russian company will receive 5% of ordinary voting shares in BP, and the British company — 9.5% of Rosneft shares).»). The deal received mixed reviews from commentators. So, a representative of the investment Bank Barclays called it a manifestation of mutual trust of the parties. On the other hand, critics noted the dubious legal purity of the transaction. The economist, an influential British weekly, used the words "buying stolen goods" to remind that Yukos shareholders are suing the Russian government for more than $100 billion.

Russian co-owners of TNK-BP (50% of it belongs to BP, and another 50% to the AAR consortium, which includes Alfa group, Access Industries and "Renova) criticized BP's deal with Rosneft and filed a lawsuit in a London court to suspend it. on January 31, 2011, in protest against the deal, Russian shareholder TNK-BP decided to block the payment of $1.8 billion in dividends. On March 24, 2011, the Stockholm arbitration court ruled to ban the deal between BP and Rosneft, and on may 17, 2011, it was reported that the deal was disrupted.

March 21, 2013 in the official press release "Rosneft" has announced the completion of the transaction for the purchase of 100 % TNK-BP.

Azerbaijan

First office in Baku was opened in June 1992. In September 1994 BP, The state Oil Company of Azerbaijan (SOCAR), the government of Azerbaijan and 11 other companies from 8 countries have signed the so-called "contract agreement".Contract of the century, an agreement on joint field development Azeri, Chirag and the deep-water part of the Gunashli field in Azerbaijan In the Caspian sea within the framework of the agreement on the division of oil production. Initially, it was calculated until 2024, and in 2017 it was extended until 2050 (SOCAR increased its share from 11 % to 25 %, BP's share is 30.37% and it is the development operator).

The Shah Deniz field was discovered in 1999, and the project for its development, in which BP's share is 28.83 %, includes two phases: "Shah Deniz 1 " and "Shah Deniz 2". Work on Shah Deniz 1 began in 2006. The maximum production in the first phase is 10 billion cubic meters of gas per year and 50 thousand barrels of condensate per day. In 2017, the field produced 10.2 standard cubic meters of gas and 2.4 million tons of condensate per year. Work on the second phase was started in 2016, and it was 99% ready for 2018.

An infrastructure called the southern gas corridor has been created for the export of hydrocarbons. It includes the Baku-Tbilisi-Ceyhan oil pipeline (1,768 km long, with a capacity of 1 million barrels per day), the South Caucasus gas pipeline (693 km long, with a capacity of 143,000 barrels per day),The TRANS-Anatolian pipeline and TRANS-Adriatic pipeline (TAP) (connecting Shah Deniz with Italy, via the territory of Greece and Albania)[36], as well as the Sangachal terminal.

Other countries in Asia and Australia

In addition to Russia and Azerbaijan, BP operates in United Arab Emirates, China, India, Indonesia, In Iraq, Kuwait and Oman, as well as in Australia.

China has a share in shale gas production in the Sichuan basin (total area 2500 km2, development operator China National Petroleum Corporation), as well as a share in Guangdong regasification terminal and gas storage facility (30% each).

In partnership with a local oil company, oil and natural gas production is carried out in Abu Dhabi (UAE, BP's share is 10%). The production level in 2017 was 257 thousand barrels of oil per day.

In Oman, natural gas is being produced in the Khazzan field (in partnership with the oil company of Oman, BP's share is 60 %).

In Iraq, BP has a 47.6% share in one of the world's largest oil fields, Rumaila, and is the main development contractor, with an average production rate of 73,000 barrels per day in 2017.

In Indonesia, the company is the operator of the Tangguh LNG project (and has a 40% stake); this project includes 14 natural gas wells, two offshore platforms, two gas pipelines and a 7.6 million-ton-per-year liquefied natural gas plant. By 2020, it is planned to increase the project's productivity almost twice.

In Australia, since the 1980s, the company has been one of seven participants in the North West Shelf project (BP's 16.67% share), which includes oil and natural gas production and liquefied gas production; BP accounts for 2.7 million tons of liquefied gas per year.

Europe

Oil and gas production in Europe is concentrated in the North and Norwegian seas in the territorial waters of great Britain and Norway; the largest field is located in the Shetland Islands. The production level in 2017 was 80 thousand barrels of oil and 5 million cubic meters of gas per day.

North America

In North America, the main region of oil production is the Gulf of Mexico. In the United States, the company has licenses for sites in Arkansas, Colorado, new Mexico, Oklahoma, Texas and Wyoming, with proven reserves totaling 1.4 billion barrels of oil equivalent, mainly shale gas reserves. The company has been producing oil and gas from the field since 1977 Pradho Bay has produced 12.5 billion barrels of oil during this time, and the company also owns a 49% stake in TRANS-Alaska oil pipeline connecting the field to the port Valdez in southeastern Alaska. In addition, a liquefied gas production plant with a capacity of 20 million tons per year is under construction. The level of production in 2017 was 370 thousand barrels of oil per day, including 251 thousand barrels in the Gulf of Mexico and 109 thousand in Alaska, natural gas production was 50 million cubic meters per day.

In Canada, oil Sands are being developed (Sunrise Oil Sands, Terre de Grace, Pike Oil Sands). There are also licenses for offshore areas on the Canadian shelf that are not being developed yet. The production level in 2017 was 20 thousand barrels of oil per day.

In Mexico, oil production is carried out in the Saline Basin field in equal shares with Statoil and Total.

South America

In South America, oil and gas production is conducted in Brazil and Trinidad and Tobago, and through Pan American Energy Group (a joint venture between BP and Argentina's Bridas Corporation) also in Argentina and Bolivia. The level of production in Argentina in 2017 was 60 thousand barrels of oil per day, in Bolivia 3 thousand barrels.

In Brazil, the company received 21 concessions in 5 swimming pools (Pre-Salt Bid Round, North Campos, South Campos, Barreirinhas, Foz do Amazonas Basin).

In Trinidad and Tobago, natural gas and gas condensate are produced in offshore areas with a total area of 7,300 km2, where the company's 14 platforms are located. BP has a 39 % stake in the Atlantic LNG LNG plant, which corresponds to a capacity of 15 million tons per year. The production level in 2017 was 22 thousand barrels of oil and gas condensate per day and 55 million cubic meters of natural gas.

Africa

In Africa, the company works with Sonatrach and Statoil to produce oil and natural gas in Algeria and offshore Angola. The production level in 2017 was 192 thousand barrels of oil per day in Angola and 10 thousand in Algeria.

Egypt's Nile Delta region is home to oil and gas production, with BP accounting for 10% of the country's oil and 40% of its gas production. The production level in 2017 was 40 thousand barrels of oil per day.

In partnership with Kosmos Energy, oil is produced in Ivory coast, Libya, Mauritania and Senegal.

Incidents

An explosion at an oil refinery in Texas

March 23, 2005 at the company BP, located in the state of Texas, there was an explosion that turned into a fire. As a result of the accident, 15 people were killed and another 170 were injured. The company announced a payment of more than $700 million to the victims and families of those killed in the accident.

Hurricane Dennis

Hurricane that occurred in July 2005 "Dennis" caused serious damage to BP's operations inThe Gulf of Mexico. The disaster caused serious damage to the Thunder Horse oil production platform, one of the largest in the world, built by BP together with ExxonMobil. As a result of the hurricane's impact, the platform tilted by 30°, and the cost of restoring it was about $100 million.

The explosion of the Deepwater Horizon oil platform

On April 20, 2010, on a semi-submersible oil platform leased by BP from Transocean Deepwater Horizon, which operated in the Central part of the Gulf of Mexico South of the state Louisiana (USA), an explosion occurred. As a result of the subsequent fire, which was unsuccessfully fought, 11 people were killed and 17 others were injured; on April 22, the platform sank. The free flow of oil from the well where the platform was operating before the disaster caused a major environmental disaster: up to 1000 tons of oil were poured into the water from a well located at a depth of about 1.5 km per day. The oil slick, whose area was approaching 1,000 km2, led to serious pollution of the coast of Louisiana and other US States. A number of experts estimated the amount of damage caused in the amount of up to $37 billion.

By June 2, 2010, attempts to stop the release of oil remained unsuccessful. By June 10, the company had lost a significant portion of its market capitalization (since the accident, it has fallen from $186 billion to $91 billion).); the cost of the clean-up operation exceeded $760 million. By mid-June 2010, unsuccessful attempts to deal with the consequences of the accident and increasingly loud demands for multibillion-dollar compensation for the damage caused led to a sharp drop in BP's ratings: Fitch Agency it lowered the company's long-term rating by as much as six notches — from AA (high reliability) to BBB (only two positions above the "junk" level). In July, it was announced that the head of BP Tony Hayward will retire in the fall, which was also associated with the disaster at Deepwater Horizon.

In early August 2010, it became known that the oil leak was almost completely stopped. It was also announced that 75% of the spilled oil disappeared from the surface of the Gulf of Mexico due to natural causes or due to disposal efforts.

BP began to prepare in advance for the possible multibillion-dollar costs of eliminating all the consequences of the disaster, in particular, by starting the sale of its property. In July 2010, the company announced the sale of its gas assets and gas processing plants to the American company Apache for $7 billion. The company later created the Gulf Coast Claims Facility (GCCF) Fund, which provides compensation for damages. In total, $20 billion was reserved in this Fund.

On January 5, 2011, a US government Commission created at the initiative of President Obama called the cause of the disaster the reduction of funds by BP and its partners to ensure the safety of oil production.

In April 2011, BP filed $40 billion in lawsuits against three companies that it believes were responsible for the platform accident: Transocean (owner and operator of Deepwater Horizon), Halliburton (who designed the cement "seal" for the well) and Cameron (manufacturer of a failed device to block the well in case of accidents). A month later, the Japanese company Mitsui & Co., which was a co-owner of the project in which the Deepwater Horizon platform worked, announced compensation in the amount of $1.1 billion in favor of BP. In early 2012, the US Federal court decided that BP itself should be the main defendant in claims for recovery of material liability, and its contractor partners should not participate in damages.

In April 2012, BP reached a final agreement with the persons who were harmed in the accident. The company pledged to pay 100 thousand American plaintiffs (including hotel owners, restaurant owners, fishermen, etc.) compensation in the total amount of $7.8 billion.

Subsidiaries

Major subsidiaries and partnerships at the end of 2017 (share, jurisdiction, business line):

- BP Corporate Holdings (100 %, England and Wales, investment holding company)

- BP Exploration Operating Company (100 %, England and Wales, mining and production)

- BP Global Investments (100 %, England and Wales, investment holding company)

- BP International (100 %, England and Wales, integrated oil company)

- BP Oil International (100 %, England and Wales, integrated oil company)

- Burmah Castrol (100 %, Scotland, lubricants)

Angola

- BP Exploration (Angola) (100 %, England and Wales, mining and production)

Azerbaijan

- BP Exploration (Caspian Sea) (100 %, England and Wales, mining and production)

- BP Exploration (Azerbaijan) (100 %, England and Wales, mining and production)

Canada

- BP Holdings Canada (100 %, England and Wales, investment holding company)

Egypt

- BP Exploration (Delta) (100 %, England and Wales, mining and production)

Germany

- BP Europa SE (100 %, oil refining and marketing)

India

- BP Exploration (Alpha) (100 %, England and Wales, mining and production)

Trinidad and Tobago

- BP Trinidad and Tobago (70 %, of the United States, mining and production)

Great Britain

- BP Capital Markets (100 %, England and Wales, Finance)

USA

- BP Holdings North America (100 %, England and Wales, investment holding company)

- Atlantic Richfield Company (100 %, United States, integrated oil company)

- BP America (100 %, United States, integrated oil company)

- BP America Production Company (100 %, United States, integrated oil company)

- BP Company North America (100 %, United States, integrated oil company)

- BP Corporation North America (100 %, United States, integrated oil company)

- BP Exploration (Alaska) (100 %, United States, integrated oil company)

- BP Products North America (100 %, United States, integrated oil company)

- Standard Oil Company (100 %, United States, integrated oil company)

- BP Capital Markets America (100 %, USA, Finance)

Russia

- «Rosneft (19.75 %, Russia, integrated oil company)