Space technology supported by investors

Investors have invested record sums in space technology start-ups for the second year in a row. This was reported by The Times.

According to its data, in 2022, space technology projects received about $8.9 billion in funding. This is less than last year's figure, but significantly higher than the funding received in previous years. According to experts at Seraphim Space, a company that invests in space technology, the amounts remain at record highs and will grow as economic sentiment improves.

The space industry is facing a slowdown in funding due to growing concerns about the economy. Investment in space-related start-ups fell by less than half last year after reaching peak levels throughout 2021.

Seraphim Space is still seeing some bright signs. "Projects grew in 2022 by about 50 percent, indicating investor interest in early-stage startups, despite the economic downturn," it said.

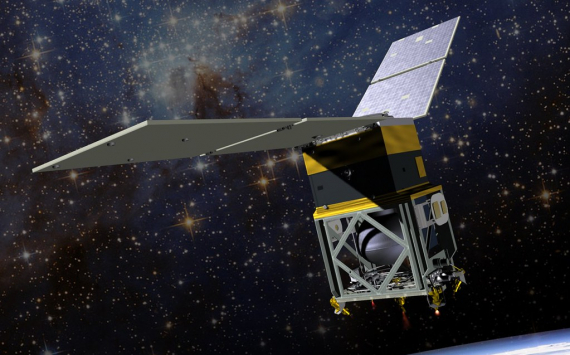

The US remains the leader in space technology but UK, India, Australia and Germany are also the biggest investors in this area. Venture capital helped to launch AST SpaceMobile, a $1.2 billion satellite communications company, and data and analytics company Spire Global, which has a market value around $200m.

Last year, Northern Sky Research predicted the global space industry would generate $1.25 trillion in revenue by 2030, representing a compound annual growth rate of 6.25%.

Macroeconomic concerns have prompted space companies to prioritise proven business models, revenues and government contracts, wrote venture capital firm Space Capital in a report last month.

The main investment trends for 2023 are expected to be in space broadband, the commercialisation of renewed interest in lunar missions and space companies taking advantage of rising national defence budgets amid the Ukrainian conflict. Investment inflows are recorded in both the space hardware and data analytics sectors.